Latest News

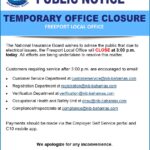

Public Notice: Temporary Office Closure – Freeport Local OfficeJuly 23, 2025The National Insurance Board wishes to advise the public that due to electrical issues, the Freeport Local Office will CLOSE at 3:00 pm today. All efforts are being undertaken to resolve this matter. Read More...

Public Notice: Temporary Office Closure – Freeport Local OfficeJuly 23, 2025The National Insurance Board wishes to advise the public that due to electrical issues, the Freeport Local Office will CLOSE at 3:00 pm today. All efforts are being undertaken to resolve this matter. Read More... Renew Your NIB Card Online With Ease!July 18, 2025NIB Card - EzRENEW - Log on to www.nibonline.nib-bahamas.comRead More...

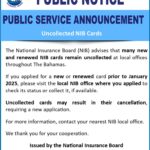

Renew Your NIB Card Online With Ease!July 18, 2025NIB Card - EzRENEW - Log on to www.nibonline.nib-bahamas.comRead More... Public Notice – Public Service Announcement – Uncollected NIB CardsJuly 18, 2025The National Insurance Board (NIB) advises that many new and renewed NIB cards remain uncollected at local offices throughout The Bahamas. Read More...

Public Notice – Public Service Announcement – Uncollected NIB CardsJuly 18, 2025The National Insurance Board (NIB) advises that many new and renewed NIB cards remain uncollected at local offices throughout The Bahamas. Read More...

2001-2002

Major achievements occurring during this period included:

- The completion the clinic at South Beach, New Providence.

- The completion of the 7th Actuarial Review of the National Insurance Fund. The review examined the Fund’s current and projected future financial status and made recommendations for steps that may be taken to help ensure that NIB remains solvent for future generations, while providing meaningful benefits to current workers and pensioners. The main findings of the review were:

The main findings of the review were:

- If the present contribution rate and benefit provisions are maintained, the National Insurance Fund would be exhausted in 2029.

- Should this occur, the contribution rate would have to be increased to 17% and then gradually thereafter to over 25% for NIB to continue meeting its benefit commitments.

- The average cost of benefits payable over the next 60 years is 15.5% compared with the current average contribution rate of 8.4%.

- Review the level of the insurable wage ceiling and thereafter increase it annually with rules governing such adjustments placed in National Insurance Regulations.

- Increase pensions annually in line with changes in the cost of living.

- Gradually increase the contribution period required to qualify for a Retirement pension from 3 to 10 years.

- Gradually increase the number of years over which wages are averaged for calculating pensions so that pension amounts more closely reflect earnings over one’s career, and not just over only the three years with greatest earnings.

- Consider paying more than just the greater of Retirement and Survivors benefits where the widowed spouse has earned his/her own pension.

- Ensure that the income test applied to non-contributory pensioners is strictly adhered to so that only those who are truly eligible receive assistance payments.

- Review the terms under which pensionable civil servants participate in the National Insurance programme with an objective of enacting similar provisions for all insured persons.

- Initiate a comprehensive review of NIB’s Act & Regulations. This review should ensure that all provisions are relevant to prevailing socio-economic conditions and that legislation is consistent with current practice, intent, and other Bahamian laws.

- Approve and adopt an Investment Policy Statement for the investment of the Board’s assets and seek new investment avenues for surplus funds, both locally and abroad.

- Reduce significantly the amount spent on administrative expenses from the 19.2% of contribution income spent in 2001 to 10% over the medium term.

- Provide to all past and current contributors annual contribution statements that indicate past contributions, their benefit eligibility status and what, if any, additional contributions are required to qualify for certain benefits.

- Initiate extensive public relations campaigns aimed at increasing general awareness of National Insurance, the benefits offered, the need to plan for retirement, and the future challenges and reforms that will be required. While no immediate contribution rate increase was recommended, the need for future rate increases was stressed.

- The commencement of a compensation review and manpower needs assessment exercise for staff members in the two bargaining units. Objectives of the exercise included:

- To provide NIB with accurate market information for future revisions to salary scales;

- To conduct an audit of the current ranking of NIB jobs;

- To ensure that all job descriptions and job charts reflect current structure and account abilities, identifying the key factors that affect the level of each position; and

- To provide an analysis of NIB functional areas to determine the number of persons needed at the management/supervisory and non-management levels.

- The completion of the Headquarters building to house and facilitate various agencies and services of the Royal Bahamas Police Force in Grand Bahama.

- The completion of the multi-million dollar Poincianna Hill Office Complex, which houses the Ministry of Health; and the Thompson Boulevard Complex, which houses the Ministry of Education.

- The official opening of two new community Health Centres in Harbour Island and Spanish Wells.

ADMINISTRATION & FINANCE

The Honourable Theresa Moxey-Ingraham, held ministerial responsibility for National Insurance as Minister of Public Service & Cultural Affairs through 2001 and into 2002; the Honourable D. Shane Gibson, assumed responsibility in May 2002 as Minister of Housing & National Insurance. Mr. J.M. Pinder, continued as Chairman of the Board of Directors into 2002, with Mr. Philip Davis, M.P., assuming the role of Chairman in July 2002. Mr. Lennox McCartney served as Director and was responsible for the day-to-day operations of the organization. Mrs. V. Theresa Burrows joined the Board as Deputy Director; and Royston Jones, Financial Controller and Arlean Strachan, Assistant Director resigned/retired respectively.

NIB’s Reserve Fund stood at 1.1 billion dollars at the end of 2001.

- 11th Actuarial Review

- 10th Actuarial Review

- 2021 Annual Report

- 2020 Annual Report

- 2019 Annual Report

- 2018 Annual Report

- 2017 Annual Report

- 2016 Annual Report

- 2015 Annual Report

- 2014 Annual Report

- 2013 Annual Report

- 2012 Annual Report

- 9th Actuarial Review

- 2011 Annual Report

- 2009 Annual Report

- 2010 Annual Report

- 2008 Annual Report

- 2005 SSRC Report

- 8th Actuarial Review

- 7th Actuarial Review