Latest News

Request for EOI Repairs and Renovations to Marsh Harbour ComplexDecember 9, 2025The National Insurance Board (NIB) is soliciting an Expression of Interest from qualified Bahamian contractors to bid on providing repair works and renovationsRead More...

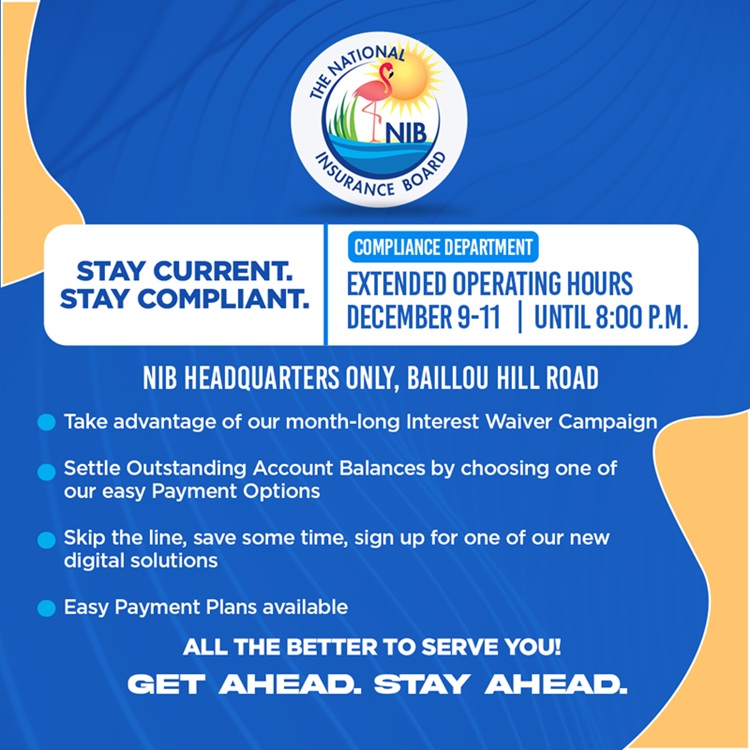

Request for EOI Repairs and Renovations to Marsh Harbour ComplexDecember 9, 2025The National Insurance Board (NIB) is soliciting an Expression of Interest from qualified Bahamian contractors to bid on providing repair works and renovationsRead More... Interest Waiver CampaignDecember 8, 2025STAY CURRENT. STAY COMPLIANT. COMPLIANCE EXTENDED, OPERATING HOURS…UNTIL 8 P.M.Read More...

Interest Waiver CampaignDecember 8, 2025STAY CURRENT. STAY COMPLIANT. COMPLIANCE EXTENDED, OPERATING HOURS…UNTIL 8 P.M.Read More... Vacancy Notice – Senior Manager (Public Affairs and Communications) Public Affairs & Communications DepartmentOctober 31, 2025Applications are invited from suitably qualified candidates for the position of Senior Manager (Public Affairs and Communications), Public Affairs & Communications Department.Read More...

Vacancy Notice – Senior Manager (Public Affairs and Communications) Public Affairs & Communications DepartmentOctober 31, 2025Applications are invited from suitably qualified candidates for the position of Senior Manager (Public Affairs and Communications), Public Affairs & Communications Department.Read More...

Employers

The National Insurance programme is a partner with employers in advancing the economic security of workers of The Bahamas. When employers pay contributions on behalf of workers, they are released from the obligation of paying full wages when employees are off sick or on maternity leave, and they are excused from liability when job-related injuries and diseases happen.

Businesses (employers) and self-employed persons are required to register with NIB within 10 working days of commencing operations. The employer/self-employed are assigned a unique nine (9) digit number for the payment and recording of contribution payments.

To register Employers must:- Obtain a business license from the Department of Inland Revenue

- Complete and submit Form R1 to the National Insurance Board

- Show NIB Smart Card, another form of government identification or voter’s card at the time of registration

Contributions are to be paid monthly, and should be received into the Board by the 15th day of the month following the month they were due. Click here to read more.

For information on the Employer’s Self Service Portal Click here

A Letter of Good Standing is issued by the National Insurance Board (NIB) verifying that an Employer’s account is current and that NIB has no objection with issuing a letter stating that the Employer does not owe NIB. To obtain a Letter of Good Standing, an Employer must:

- Register the name of the business with NIB;

- Have a current account with the correct rate of contribution payments. Contribution payments must be paid for all employees;

- Download the Contribution Status Letter Form which may be found on the NIB website: www.nib-bahamas.com

- Email the completed form to compliance@nib-bahamas.com or submit form at a local NIB office.

Processing time is 5 (five) business days. If collecting on behalf of an Employer, an authorization letter is required.

- 11th Actuarial Review

- 10th Actuarial Review

- 2021 Annual Report

- 2020 Annual Report

- 2019 Annual Report

- 2018 Annual Report

- 2017 Annual Report

- 2016 Annual Report

- 2015 Annual Report

- 2014 Annual Report

- 2013 Annual Report

- 2012 Annual Report

- 9th Actuarial Review

- 2011 Annual Report

- 2009 Annual Report

- 2010 Annual Report

- 2008 Annual Report

- 2005 SSRC Report

- 8th Actuarial Review

- 7th Actuarial Review