Latest News

It’s Day 3 and NIB is still Ringing For The CauseDecember 17, 2025Executives and staff of National Insurance Board of The Bahamas are continuing to proudly ring the bell in support of The Salvation Army's Red Kettle Bell fundraiser...Read More...

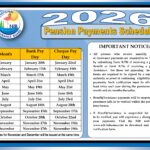

It’s Day 3 and NIB is still Ringing For The CauseDecember 17, 2025Executives and staff of National Insurance Board of The Bahamas are continuing to proudly ring the bell in support of The Salvation Army's Red Kettle Bell fundraiser...Read More... 2026 Pension Payments ScheduleDecember 16, 2025All persons who receive monthly Benefit or Assistance payments are required to be verified by submitting Form B.75b if receiving a pension Benefit or Form B.75a if receiving a pension AssistanceRead More...

2026 Pension Payments ScheduleDecember 16, 2025All persons who receive monthly Benefit or Assistance payments are required to be verified by submitting Form B.75b if receiving a pension Benefit or Form B.75a if receiving a pension AssistanceRead More... NIB has partnered with the Salvation Army’s Red Kettle Bell FundraiserDecember 15, 2025We’re Giving Back This Season; and we are proud to partner with the Salvation Army’s Red Kettle Bell Fundraiser. Join us at NIB Headquarters on Baillou Hill Road as we ring the bell today through Wednesday, December 17, between 10:00 a.m. and 3:00 p.m.Read More...

NIB has partnered with the Salvation Army’s Red Kettle Bell FundraiserDecember 15, 2025We’re Giving Back This Season; and we are proud to partner with the Salvation Army’s Red Kettle Bell Fundraiser. Join us at NIB Headquarters on Baillou Hill Road as we ring the bell today through Wednesday, December 17, between 10:00 a.m. and 3:00 p.m.Read More...

Finance

The National Insurance Fund comprises trust funds, belonging to the National Insurance Board’s contributors; the trusteeship principles of safety, yield and liquidity apply to all investments of the Fund. Hence, all investments of the Fund are required to meet these criteria. The Fund must be invested so as to adequately meet both the present and future cost of benefits and assistance.

Total reserve investment can be categorized as either cash or non-cash investments. The total income of the National Insurance Programme is spread between different reserves to allow for payment of benefits and assistances under various categories, and all Fund investments are spread between short, medium and long-term placements so as to match corresponding future benefit obligations.

Categories of investments are as follows:

- Bahamas Government Registered Stock;

- Treasury Bills;

- Bank Deposits;

- Long-term bonds/loans to quasi-government corporations;

- Equity investments; and

- Net investment in direct financing lease.

- 11th Actuarial Review

- 10th Actuarial Review

- 2021 Annual Report

- 2020 Annual Report

- 2019 Annual Report

- 2018 Annual Report

- 2017 Annual Report

- 2016 Annual Report

- 2015 Annual Report

- 2014 Annual Report

- 2013 Annual Report

- 2012 Annual Report

- 9th Actuarial Review

- 2011 Annual Report

- 2009 Annual Report

- 2010 Annual Report

- 2008 Annual Report

- 2005 SSRC Report

- 8th Actuarial Review

- 7th Actuarial Review