Latest News

Request for EOI Repairs and Renovations to Marsh Harbour ComplexDecember 9, 2025The National Insurance Board (NIB) is soliciting an Expression of Interest from qualified Bahamian contractors to bid on providing repair works and renovationsRead More...

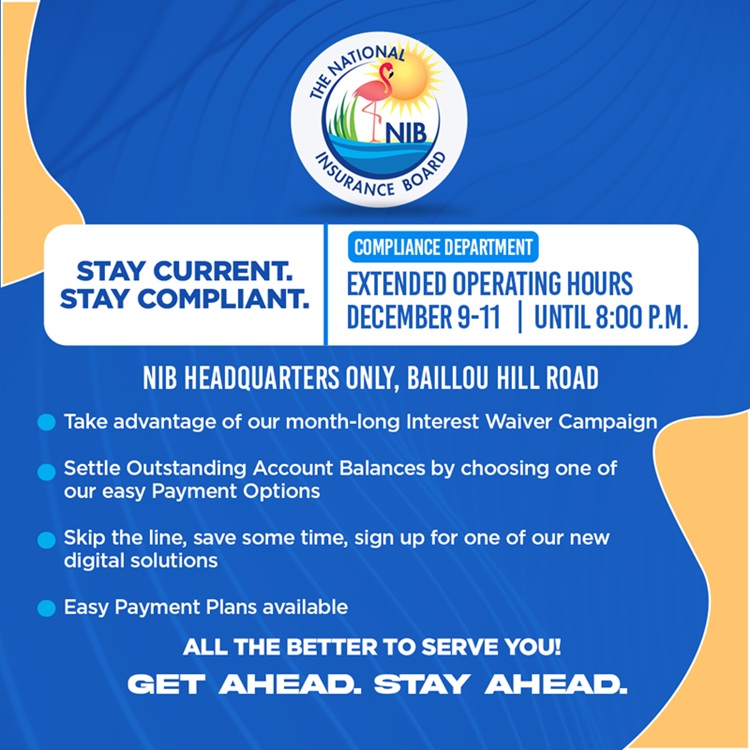

Request for EOI Repairs and Renovations to Marsh Harbour ComplexDecember 9, 2025The National Insurance Board (NIB) is soliciting an Expression of Interest from qualified Bahamian contractors to bid on providing repair works and renovationsRead More... Interest Waiver CampaignDecember 8, 2025STAY CURRENT. STAY COMPLIANT. COMPLIANCE EXTENDED, OPERATING HOURS…UNTIL 8 P.M.Read More...

Interest Waiver CampaignDecember 8, 2025STAY CURRENT. STAY COMPLIANT. COMPLIANCE EXTENDED, OPERATING HOURS…UNTIL 8 P.M.Read More... Vacancy Notice – Senior Manager (Public Affairs and Communications) Public Affairs & Communications DepartmentOctober 31, 2025Applications are invited from suitably qualified candidates for the position of Senior Manager (Public Affairs and Communications), Public Affairs & Communications Department.Read More...

Vacancy Notice – Senior Manager (Public Affairs and Communications) Public Affairs & Communications DepartmentOctober 31, 2025Applications are invited from suitably qualified candidates for the position of Senior Manager (Public Affairs and Communications), Public Affairs & Communications Department.Read More...

Contributions

Contributions are required for each “contribution week” - a period of seven days, from Monday to Sunday. Payments are based on the wages earned during the week, up to an insurable ceiling –$810 (as of July 2024) (see Contribution Table). Contributions are to be paid monthly, and should be received into the Board by the 15th day of the month following the month they were due.

EMPLOYED PERSONS: Contributions are to be deducted from the employed person’s wages before they are paid. Deductions are payable from the very first salary payment - even if the worker is serving out a probationary period. Contributions not deducted at the time they were due, cannot be reclaimed from employees’ future earnings. The employer is solely responsible for payment of arrears.

“Wages” includes basic pay (inclusive of pay in lieu of notice) and formally paid tips/gratuities; compensations such as bonuses. Overtime and severance are not considered wages.

Contributions for persons, who are paid on a commission basis, will be based on the average weekly or monthly wage in the last year or the total wage paid in the actual week or month concerned.

Contributions for persons paid on a daily or piece-work basis, will be based either on the basic amount paid for similar work, or on the total cash amount paid for the actual week or month – whichever is less.

| Contributor | Current Contribution Rates (To June 30, 2024) |

New Contribution Rates (As of July 1, 2024) |

|---|---|---|

| Employee | 3.9% | 4.65% |

| Employer | 5.9 % | 6.65% |

SELF-EMPLOYED PERSONS: A self-employed person must determine at the beginning of each year what his/her income level for the payment of contributions will be that year. The projection must be reasonable as it will be subject to the review of the NIB.

| Current Contribution Rate (To June 30, 2024) |

New Contribution Rate (As of July 1, 2024) |

|---|---|

| 8.8% | 10.3% |

PERSONS WITH DUAL EMPLOYMENT: Only one contribution payment is required for a worker during any contribution week, therefore, persons with two or more employers are only required to have contributions paid for them, by the “principal” employer. The principal employer is, generally, the first employer to whom the worker reports, or the employer who pays the wages first during a contribution week.

PERSONS IN RECEIPT OF RETIREMENT BENEFIT: A person age 60 to 64, who is in receipt of Retirement Benefit, may return/continue to work and receive the benefit, as long as he/she earns no more than half of the insurable wage ceiling.Additionally, persons age 65 years and older may work and receive Retirement Benefit no matter what they earn. In the case of self-employed persons, however, they must have initially retired from, and then returned to gainful employment to qualify. In either case, reduced contributions of 2% must be paid. For employed persons, only the employer is required to pay.

| Insured Person In Receipt of Retirement Benefit | Contribution Rate |

|---|---|

| Employed persons ages 60 to 64, earning less than 50% of ceiling, and in receipt of Retirement Benefit | 2.0% (paid by the Employer) |

| Employed persons age 65 and over and in receipt of Retirement Benefit | 2.0% (paid by the Employer) |

| Self-Employed persons ages 60 to 64, earning less than 50% of ceiling, and in receipt of Retirement Benefit | 2.0% |

| Self-Employed persons age 65 and over and in receipt of Retirement Benefit | 2.0% |

VOLUNTARILY INSURED PERSONS: An unemployed person, who was previously employed as an employed or self-employed person, may apply for permission to pay contributions voluntarily within one (1) year of ceasing to be employed.

Contributions paid voluntarily do not count for Sickness, Maternity, Unemployment or any Industrial Benefits.

The privilege of paying as a Voluntarily Insured Person is afforded only to persons resident in The Bahamas, and the application for permission to pay must be made within a year of contributing as either employed or self-employed.

| Current Contribution Rate (To June 30, 2024) |

New Contribution Rate (As of July 1, 2024) |

|---|---|

| 5% | 6.5% |

- 11th Actuarial Review

- 10th Actuarial Review

- 2021 Annual Report

- 2020 Annual Report

- 2019 Annual Report

- 2018 Annual Report

- 2017 Annual Report

- 2016 Annual Report

- 2015 Annual Report

- 2014 Annual Report

- 2013 Annual Report

- 2012 Annual Report

- 9th Actuarial Review

- 2011 Annual Report

- 2009 Annual Report

- 2010 Annual Report

- 2008 Annual Report

- 2005 SSRC Report

- 8th Actuarial Review

- 7th Actuarial Review